The Neuroscience of Risk: How Our Brains Process Financial Uncertainty

OVERVIEW

- Introduction

- Brief overview of the intersection between neuroscience and financial decision-making

- The importance of understanding risk processing in personal and professional finance

- The Neuroanatomy of Risk Assessment

- Key brain regions involved in risk processing (e.g., amygdala, insula, prefrontal cortex)

- How these regions interact during financial decision-making

- Neurotransmitters and Risk-Taking Behavior

- The role of dopamine in reward-seeking and risk-taking

- How serotonin levels might influence risk aversion

- Cognitive Biases in Risk Perception

- Loss aversion: Why losses loom larger than gains

- The affect heuristic: How emotions influence risk assessment

- Probability neglect: Overreacting to small risks in complex situations

- Individual Differences in Risk Processing

- How experience modify neural risk processing

- Implications for Financial Decision-Making

- How understanding neural risk processing can improve personal financial choices

- Conclusion

- Recap of the importance of neuroscience in understanding financial risk-taking

- Call for interdisciplinary research and application of findings

Imagine you're standing at a roulette table in a Las Vegas casino. The wheel spins, the ball bounces, and your heart pounds. Do you bet it all on black or walk away? Instantaneously, your brain becomes a hive of activity– neurons firing, chemicals surging, ancient instincts battling modern logic. But here's the kicker: your brain reacts almost identically when you're about to click 'buy' on a fire tee on Depop and when you gamble your life savings away.

Welcome to the neural casino of financial decision-making. Every choice you make is a spin of the wheel, and your brain is the house; except in this casino, you can learn to tilt the odds in your favor.

When you think of finance, what do you think of it? Spreadsheets, algorithms, economic theories, and many nonlinear regressions. Whatever it may be, it may not be the case. Contrary to popular belief, new frontiers are emerging at the intersections of neuroscience and finance. This fusion of brain science and money matters is revolutionizing our understanding of how we make financial decisions, particularly risk and uncertainty.

At its core, every decision we make is a neural process. Our brains aren't meant to be cold, unemotional calculators of personal gain. Instead, they're crucial organs finetuned to allow us to feel– to enable us to love, appreciate, and be grateful for what we are and have.

Understanding this intersection between neuroscience and financial decision-making is crucial for several reasons:

- It sheds light on why we sometimes make seemingly irrational financial choices that leave economists scratching their heads.

- It helps explain why your risk tolerance is better from your neighbor's.

- Most importantly, it offers potential strategies for improving financial decision-making, both in our personal lives and professional settings.

For individuals, grasping how their brain responds to financial decisions is the key to better money moves; whether it be saving for retirement or investing in the stock market. While, on a more grandiose scale, this knowledge can lead to better risk management strategies and more effective client communication for large-scale governments and corporations.

As we dive deeper into the gray matter behind the green, we'll explore the brain regions involved in risk assessment, how neurotransmitters influence our financial behavior, and even how factors like experience play a role. By the end, you'll have a new perspective on your financial mind - and maybe, just maybe, you'll be better equipped to beat the house in life's impossible neural casino.

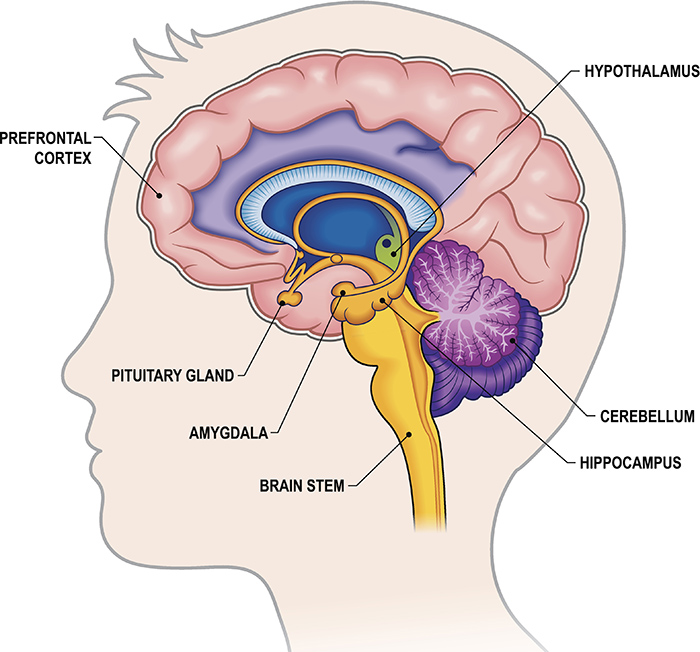

Neuroanatomy of Decision Making

When it comes to financial decision-making, your brain doesn't just flip a coin–it engages a complex network of regions, each playing a crucial role in how you process and respond to risk. Let's explore the key players in your brain's financial risk assessment team:

- The Amygdala: Your Emotional Risk Detector

The amygdala, a small almond-shaped structure deep in the brain, acts as your emotional early warning system. It's particularly sensitive to potential threats or rewards, making it a key player in risk assessment.

- Function: Rapid emotional processing of risky situations

- Financial impact: Can trigger quick, gut reactions to market changes or investment opportunities

For example, when you see a sudden drop in your stock portfolio, your amygdala might spark that instant feeling of panic or unease.

- The Insula: Your Gut Feeling Translator

The insula serves as a bridge between your emotional and cognitive processes, interpreting bodily sensations into feelings and influencing decision-making.

- Function: Processes feelings of uncertainty and anticipation

- Financial impact: Contributes to "gut feelings" about financial decisions

Have you ever had a nagging feeling that a deal was too good to be true? That's likely your insula at work.

- The Prefrontal Cortex: Your Rational Financial Planner

Located at the front of the brain, the prefrontal cortex is your center for higher-order thinking and executive function.

- Function: Logical analysis, long-term planning, and impulse control

- Financial impact: Helps in weighing pros and cons, considering future consequences of financial decisions

This is the part of your brain that might step in to say, "Let's think this through" when you're tempted by a risky investment.

- The Nucleus Accumbens: Your Reward Center

Part of the brain's pleasure circuit, the nucleus accumbens plays a significant role in processing rewards and motivating behavior.

- Function: Anticipation of rewards and pleasure

- Financial impact: Can drive risk-seeking behavior in pursuit of financial gains

The excitement you feel when considering a potentially profitable investment? That's your nucleus accumbens lighting up.

How These Regions Interact

Financial decision-making involves a complex interplay between these brain regions. Here's a simplified scenario of how they might work together when you're faced with a risky financial decision:

- Opportunity Recognition: The nucleus accumbens activates, creating a sense of excitement about potential gains.

- Emotional Response: The amygdala quickly assesses the situation, potentially triggering fear or further excitement.

- Gut Feeling: The insula interprets these emotional signals, contributing to your intuitive sense about the decision.

- Rational Analysis: The prefrontal cortex steps in, attempting to analyze the situation logically and consider long-term consequences.

- Decision: The culmination of these processes results in your final decision.

This entire process can occur in mere seconds, often below the level of conscious awareness.

Understanding this neural dance can provide insights into your financial behavior. For instance, if you tend to make impulsive financial decisions, it might indicate that your emotionally-driven regions (amygdala, nucleus accumbens) are having a stronger influence than your rational prefrontal cortex.

It's important to note that the strength and patterns of interaction between these regions can vary from person to person, contributing to individual differences in risk tolerance and financial decision-making styles.

By recognizing the roles these brain regions play, you can potentially develop strategies to engage your prefrontal cortex more actively in financial decisions, leading to more balanced and considered choices.

Neurotransmitters and Risk-Taking Behavior

Every activity, whether it be doom-scrolling on TikTok or texting your best friend, sparks an eruption of neurochemical reactions that dictate how you feel. Whether you're down in the dumps or up in the clouds, every emotion you feel is stipulated by the release of these neurochemicals in your brain.

Thankfully, the functions remain same when you make a financial decision. Similarly to how a well-mixed cocktail can affect your actions at a party, the blend of these substances in your brain dictate how you react to significant financial decisions.

Dopamine High: Chasing Financial Rewards

What makes scrolling, videogaming, and other seemingly harmless activities so addicting?

Dopamine.

Dopamine, often called our "feel-good" neurotransmitter, plays a crucial role in our reward system and risk-taking behavior. In fact, it's the neurotransmitter that derives our emotions of happiness, joy, and satisfaction after performing an action. Evidently, it plays a crucial role in our reward systems and risk-taking behavior.

- Function: Drives reward-seeking behavior and motivates action

- Financial impact: Can fuel risk-taking and speculative investing

Imagine you're considering investing going all in on black.

High-risk, high reward.

As you contemplate the potential gains, your brain releases a small dose of dopamine, creating an artificial sense of anticipation and excitement. This dopamine hit can make these risky financial ventures feel irresistibly tempting.

The Dopamine Roller Coaster:

- Anticipation: Dopamine spikes when you anticipate a reward, like potential investment gains.

- Risk-taking: This spike can encourage you to take financial risks in pursuit of that reward.

- Outcome: If you win, you get another dopamine boost. If you lose, dopamine drops, potentially leading to risk-seeking behavior to recapture that high.

Fun fact: Studies have shown that some Parkinson's medications, which increase dopamine levels, can lead to increased risk-taking behavior, including gambling!

Serotonin: The Contentment Chemical

While dopamine pushes you to seek rewards, serotonin helps you feel grateful for what you have. It plays a crucial role in mood regulation and can influence your attitude towards financial risk.

- Function: Promotes feelings of well-being and satisfaction

- Financial impact: May encourage more conservative financial behavior

When your serotonin levels are balanced, you feel more content with your current financial situation; this eventually leading to more cautious and conservative financial decisions.

The Serotonin Effect:

- Risk Aversion: Higher serotonin levels are associated with increased risk aversion in financial decision-making.

- Patience: Serotonin can help you resist impulsive financial decisions, promoting a more long-term outlook.

- Mood Stability: By regulating mood, serotonin can help prevent emotional decision-making in finances.

Interestingly, some research suggests that fluctuations in serotonin levels might contribute to market cycles. During economic booms, collective rises in serotonin might lead to overly optimistic, risk-averse behavior, while low serotonin during busts could contribute to pessimism and panic selling.

Understanding your Unique Chemical Landscape

First and foremost, it is important to understand that we are all remarkable. While we all have these neurotransmitters, our brain's responses to these stimuli are drastically unique from one another. Genetic variations, life experiences, socioeconomic status, and even gut microbiome composition can determine how your neuroreceptors respond to these neurotransmitters. This means that what causes a dopamine spike in one person might barely register for another. Similarly, the serotonin levels that make one individual feel secure might leave another feeling overly cautious. This neurochemical individuality partly explains why financial risk tolerance varies so widely from person to person. It's not just about personality or education; it's also about the unique way your brain's chemical reception system is wired. Understanding your personal "neurochemical profile" can be a powerful tool in tailoring financial strategies that work best for you.

- Dopamine Awareness: If you find yourself constantly chasing high-risk investments, you might be riding the dopamine roller coaster. Consider implementing a "cooling off" period before making major financial decisions.

- Serotonin Boost: Engaging in activities that naturally boost serotonin (like exercise or spending time in nature) might help promote more balanced financial decision-making.

- Chemical Context: Remember that your financial decisions are influenced by your brain's chemical state. If you're feeling unusually impulsive or risk-averse, it might be worth pausing to consider your current emotional and physiological state.

By recognizing the chemical currents underlying our financial impulses, we can strive for a better balance between risk-taking and caution in our money matters.

Cognitive Biases in Risk Perception

Cognitive bias is a systematic error in thinking that directly influences judgment and decision-making. It's a tendency to process information in ways that deviate from logical, rational thinking. These biases are often unconscious and lead to inaccurate assessments, illogical interpretations, or unreasonable judgements.

Loss Aversion: Why Your Brain Hates Losing More Than It Loves Winning

Imagine finding 20 dollars on the floor of your favorite restaurant. Surely, you'd be elated. Now imagine losing that same 20 dollars from your wallet. Which event would be more significant? If you were like most people, the loss would hit harder.

Inherently, humans are possessive. Rather than seeking gain, we instinctively avert from scenarios in which we lose possessions. Welcome to loss aversion.

- What it is: The tendency to prefer avoiding losing over acquiring equivalent gains

- Financial impact: This can lead to overly conservative investment strategies or holding onto losing investments for too long in hopes of breaking even or eventually gaining profit. It is similar to the sunk cost fallacy, in a sense.

The Affect Heuristic: How emotions influence risk assessment

Do you ever find yourself buying a piece of clothing that you regret and realize its actually super ugly?

I definitely have. At one point, we have all been victims of affect heuristics: our tendency to make decisions based on our equivocal emotions rather than explicit and objective data.

Affect heuristics can lead to biased financial decisions when people make decisions based on their emotions rather than objective analysis. Someone, for example, might choose stocks based on how much they like the company rather than its financial health. This can lead to negative risk-return correlations

Probability Neglect - When the Unlikely Steals the Spotlight

Remember the recent market downturn that had everyone on edge? While the actual probability of total market collapse is extremely minute, our brains can fixate on these obscure scenarios, blowing these worries out of proportion. At the same time, we neglect more probable, less detrimental financial risks, like the slow diminishing of our savings by inflation.

Probability neglect is a cognitive bias in which people fixate on the potential outcome of an event while ignoring the actual likelihood of that event occurring. Probability neglect often leads to suboptimal choices and inefficient allocation of resources.

Individual Differences in Risk Processing: Your Personal Financial Fingerprint

Imagine observing thousands of people in identical financial situations simultaneously make a decision. Ultimately, you'd find yourself with an array of unique responses, ranging from extremely reserved to wildly risky.

Why?

When it comes to risk processing, we're all wired differently. Complex characteristics, both innate and acquired, come together to form your ability to process risk. Let's explore the fascinating factors that contribute to your personal risk tolerance "fingerprint."

Experience: The Gardener of your Risk Processing Garden

Maybe this is common sense, but I feel the need to make a section about it.

Experience shapes who you are. It is a generally accepted truth that with life and experience, one becomes wiser based off of what they have encountered.

Many, however, don't know the real reason for this: our brain's neuroplasticity.

Neuroplasticity is our brain's ability to develop response mechanisms due to experience. It is our brain's ability to "prune" our neural systems.

Over time, unused/weak neural connections are removed and new ones are introduced. By removing weak connections, our brain does a better job at responding to our everchanging environment through strengthening useful synaptic connections and eliminating the useless ones.

People who expose themselves to risky decisions, actions, or choices tend to have a higher risk tolerance compared to their counterparts.

Similarly to this process, those who experience stress also tend to have higher stress tolerance compared to their counterparts.

- Implications for Financial Decision-Making

- How understanding neural risk processing can improve personal financial choices

- Applications in professional settings (e.g., trading, investment management)

How does this information help us?

It is important to understand these processes allow us to refine our personal financial decisions:

- Better Investment Choices: Understanding that emotions influence risk perception can help individuals avoid impulsive decisions, such as panic-selling during market downturns.

- Improved Budgeting & Saving: Recognizing how the brain reacts to uncertainty can encourage better long-term planning rather than short-term gratification.

- Reduced Biases: Awareness of cognitive biases, like loss aversion (fearing losses more than valuing gains), can lead to more rational financial behavior.

- Enhanced Risk Tolerance Assessment: Understanding personal neural responses to risk can guide individuals in selecting appropriate investment strategies aligned with their psychological comfort levels.

Conclusion

Financial decision-making has deeply rooted connections to neuroscience. Risk is processed by our brains through complex interplays between cognition, emotion, and neurotransmitters. Understanding of these processes rationalizes irrational financial choices, risk tolerances, and offers ways for making smarter money decisions.

For people, this knowledge will inform investment and budgeting decisions. At a broader level, it improves risk management for institutions and policymakers. By bridging neuroscience and finance, we can develop tools to optimize financial behavior, making smart, rational decisions available to all.

Bibliography

Knutson, Brian, and Peter Bossaerts. “Neural Antecedents of Financial Decisions.” The Journal of neuroscience : the official journal of the Society for Neuroscience, August 1, 2007. https://pmc.ncbi.nlm.nih.gov/articles/PMC6673081/.

Porcelli, Anthony J, and Mauricio R Delgado. “Acute Stress Modulates Risk Taking in Financial Decision Making.” Psychological science, January 30, 2009. https://pmc.ncbi.nlm.nih.gov/articles/PMC4882097/#:~:text=This%20study%20showed%20that%20extrinsic,was%20significantly%20increased%20under%20stress.

Puderbaugh, Matt. “Neuroplasticity.” StatPearls [Internet]., May 1, 2023. https://www.ncbi.nlm.nih.gov/books/NBK557811/#:~:text=Neuroplasticity%2C%20also%20known%20as%20neural,functional%20changes%20to%20the%20brain

Rosenbloom, Michael H, Jeremy D Schmahmann, and Bruce H Price. “The Functional Neuroanatomy of Decision-Making.” The Journal of neuropsychiatry and clinical neurosciences. Accessed February 24, 2025. https://pubmed.ncbi.nlm.nih.gov/23037641/.

Soyer, Emre, and Robin M. Hogarth. “Fooled by Experience.” Harvard Business Review, May 1, 2015. https://hbr.org/2015/05/fooled-by-experience.